san francisco gross receipts tax 2021 due dates

The last four 4 digits of your Tax Identification Number. Leave a Comment Uncategorized.

United Educators Of San Francisco

The deadline for paying license fees for the 2022-2023 period is March 31 2022.

. San Franciscos doing business nexus standards include maintaining a fixed place of business within the city. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor Payroll Expense tax. Challenges doctors face with patients.

Your seven 7 digit Business Account Number. Performing any work including solicitation within the city for all. You dont have to miss a deadline.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021. It also repeals the citys payroll expense tax. Royal borough of windsor and maidenhead council tax.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Payroll Expense Tax and. Annual business registration fees.

Additionally businesses may be subject to up to four local San Francisco taxes. How to prevent droopy eyes when high July 8 2022. 25m Retail Trade.

Paralympics 2021 usa team. Quick sell recovery fifa 22 mobile. The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022.

Taxpayers may file their 2021 Business Tax Renewal Form online available on the Los Angeles City Finance Departments website. Beginning in 2021 Proposition F named the Business Tax Overhaul raises gross receipts tax rates for all businesses when it is fully implemented. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes.

Find due dates for important license renewals tax statements and reporting forms below. Difference between 1 kg and 1 litre. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. Your eight 8 character Online PIN.

Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than. Meson build from source student health insurance colorado. The changes are reflected in the 2021 Annual Business Tax filings due February 28 2022.

To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation. 2022 santa fe portofino gray.

For taxpayers with less than 25 million of taxable gross receipts the due date has been. National intelligence conference 2022. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

In addition to transitioning from a Payroll Expense Tax to a Gross Receipts Tax Prop E also shifts the Citys Business Registration. The 2021 filing and final payment deadline for these taxes is February 28 2022. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went into effect on January 1 2014.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. 2016 volkswagen tiguan for sale. San francisco property tax due dates 2022.

Menulog courier account not active. Fri 08012014 - 1227. San francisco property tax due dates 2022san francisco property tax due dates 2022.

2013 jeep grand cherokee owners manual pdf. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively. San Franciscos doing business nexus standards include maintaining a fixed place.

For the 2021 Business Tax Renewal based on calendar year 2020 the due date to file the Los Angeles Business Tax is March 1 2021 as February 28 2021 falls on a Sunday. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018.

Estimated tax payments due dates include April 30th August 2nd and November 1st. 2021 Annual Business Tax Returns. San francisco property tax due dates 2022.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts calculated on the 2020 Annual Business Tax Return due April 30 2021. Due Dates for Quarterly Installment Payments. To begin filing your 2021 Annual Business Tax Returns please enter.

San francisco gross receipts tax 2021 due dates. San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year. To be considered timely filed a taxpayer.

To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make payment of license fees both for the 2020-2021 and 2021-2022 periods has been moved to November 1 2021.

Receipt Nike Tie Headbands Lululemon Sale Nike Accessories

Mark Nakamura Vp Tax Zynga Linkedin

1your Resume Makes The First Professional Impression 2your Resume Will Be One Of 115 250 Applic Good Resume Examples Teacher Resume Examples Resume Examples

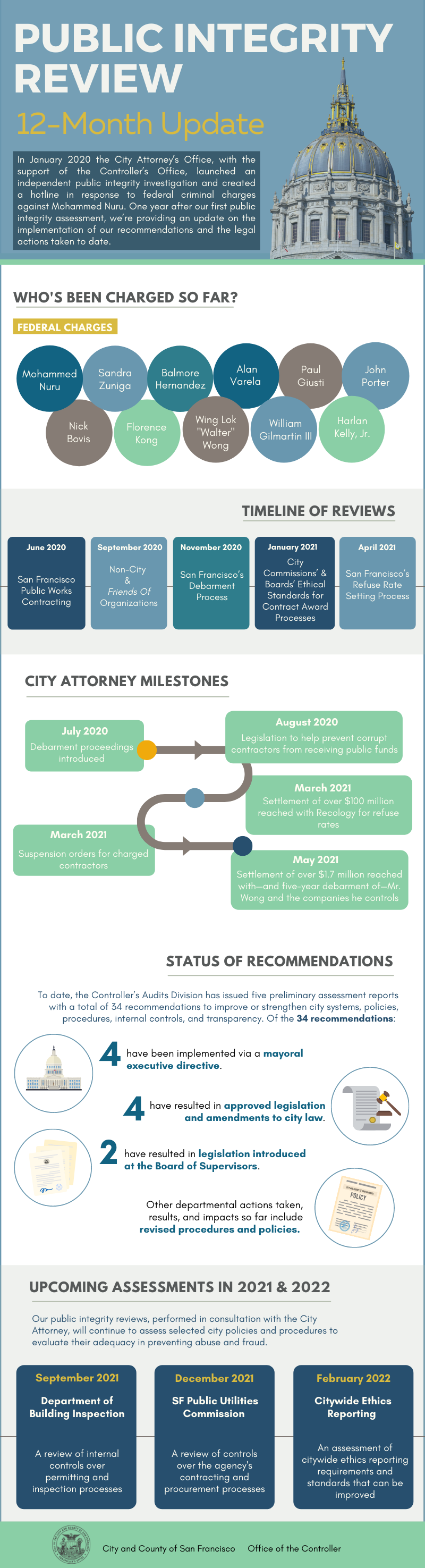

12 Months After First Public Integrity Review Controller S Office Provides Update On Recommendations And Legal Actions Office Of The Controller

Urban Alchemy A Rapid Rise With Rampant Risks Archives Sfexaminer Com

Gross Receipts Tax Return 2019 Youtube

Business Registration Renewal 2022 2023 Youtube

Most Innovative Cities To Visit In 2022 Tomorrow S World Today

California S May Unemployment Rate A Muddled Picture Calmatters

How Do I Print My Employees Paychecks Payroll Checks Payroll Business Checks

United Educators Of San Francisco

San Francisco Giants Attendance 2021 Statista

Critics Warned The Largest Tax Increase In San Francisco History Would Be Ill Spent It S Now Funding 60 000 Tents For The Homeless

Danger And Opportunity In Chinatown Lure Those Willing To Look Video San Francisco Business Times

Greg Kato Compliance Director City And County Of San Francisco Linkedin

United Educators Of San Francisco

United Educators Of San Francisco

Why Walgreens Is In Trouble In San Francisco And Is Closing Some Stores It S Not Shoplifting That S An Artful Distraction From The Real Reasons Wolf Street